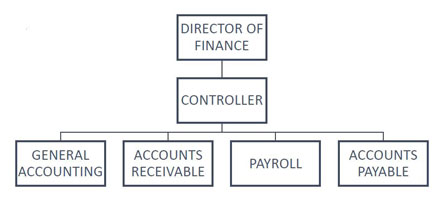

Department of Finance Flow Chart

Department of Finance Flow Chart

- The Director of Finance reports to the Bursar.

- The Controller is responsible for the day to day activities within the Department of Finance and is responsible for customer relationships within the University.

Fund Accounting and Accounting at Victoria University

Fund Accounting and Accounting at Victoria University

Victoria University manages its financial operational affairs within four funds as follows:

- The Operating Fund (prefix 0)

- The Ancillary Fund (prefix 2)

- The Restricted Fund (prefix 1 and 3) and

- The Student Awards Funds (prefix 4)

See account structure below.

In addition the University maintains an Endowment fund (also prefix 4).

Fund accounting is a financial management tool to ensure that all similar purpose revenues and

similar purpose expenses are grouped together in accordance with the intended purpose. The

definitions of each fund are included in the budgeting section of this guide.

Each Fund tracks revenues, expenses, assets and liabilities. One of the principal tenets of

generally accepted accounting principles (GAAP) is that financial statement elements should not

be netted out against each other. In other words revenues must be deposited in revenue

accounts and expenses must be paid from expense accounts.

Account Structure

Victoria uses an 11 digit account structure. For example, x-xxx-xxxx-xxx. The account is explained as follows:

- X the first digit is the Fund identifier i.e. 0 for the Operating Fund.

- XXX the next three digits identify the owner of the account (e.g. 090 = Bursar)

- XXXX the next four digits identify the Object of the account (e.g. 9100 = Bank charges)

- XXX the final 3 digits identify a sub group within the Object (e.g. 030 = Master-card charges)

Therefore, account 0-090-9100-030 indicates that this is an Operating Fund account held by the Bursar to account for Bank Charges in general, and Master-card charges in particular. Keeping the structure on this basis seems somewhat complicated but it is done not only to track expenses, but to comply with external reporting requirements. This structure allows us to summarize the accounts in many different ways.

The Chart of Accounts is the official listing of all the accounts used by the University, and is maintained by the Controller’s Office. New accounts will be added upon request.

Academic Operating Fund

Academic Operating Fund

Definition

The Operating Fund includes all general operating revenues and expenditures for the academic and administrative departments of the University. The main financial support for operations comes from:

- The Block Grant provided through U of T

- Tuition Fee Income (Emmanuel College)

- The Endowment Fund

- Real Estate income

The allocation of available operating funds across the different University departments is referred to as the budget process. This process has three distinct components: Budget Development, Budget Implementation, and Budget Management/Monitoring/Forecasting.

Budget Development

The budget for the Operating Fund is created through the annual budget process. Using a multi-year approach, and an extensive review process involving both budget managers and the President, guidelines (i.e. spending parameters, budget cuts, etc.) are developed which are incorporated into the overall process. The budget process takes place during the months of November through February culminating in presentation to the Finance Committee of the Board of Regents at its meeting in late March.

Objectives

- To ensure that the University’s operating revenue is deployed in ways which best realize the University’s objectives, approved plans and academic purposes;

- To ensure that academic and administrative units have the resources required to carry out their work effectively, subject to the constraints imposed by the flow of revenue; and

- To provide an effective means of monitoring revenue and controlling expenditures in conformity with the highest standards of financial management and accounting.

Budget Methodology

Victoria employs a rolling budget methodology whereby only the total cost of programs is addressed. Any new programs or services are “zero-based” where costs are constructed from the bottom up.

Steps in Development

- Budget Managers update 3-year plans. (November – December)

- The Bursar develops 3-year plan scenarios for use in the development of overall guidelines. (December – January)

- Using the information provided from the above two steps the President determines the overall budget adjustment percentage. (January)

- The President then meets individually with budget managers to assign a targeted budget net dollar amount.

- The Budget Managers submit their budgets in line with their allocation of funds to the Director of Finance.

- The Director of Finance assembles all the budget submissions into a comprehensive Operating Budget for the University.

- The Operating Budget is reviewed by the Senior Team before its submission to the President for his final review.

- The President completes his final review before the Operating Budget goes before the Finance Committee for recommendation to the Board.

- When the Finance Committee accepts the Operating Budget it recommends its approval to the Board of Regents.

Key Considerations

There are many factors that come into play when developing divisional/departmental budgets, a number of which are consistent throughout the University:

Possible Funding Sources

- Research overhead Departmental Income (block grant allocation, student fees, etc.)

- Expense Recoveries

- Availability of other Funds (e.g. grants, endowment, restricted)

- Carry forward Funds (e.g. unspent funds from the previous fiscal year)

General Expenditure Considerations

- One-time only expenses

- Outstanding commitments

- Transfers to/from other departments

- Budget reductions

Salary Related Expenses

- Terminations and/or retirements of staff

- New hires

- Staff benefits

- Provision for salary increases, where applicable

- Research leaves

- Maternity leaves

Other Expenses

- General price increases

- Equipment needs

- Maintenance contracts

- Computer software needs

- Supplies Stationery

Implementation

Once the Operating Budget is approved, budget managers are notified and then asked to submit line-by-line details for entry into the accounting system using the following guidelines:

- Additions and reductions must be consistent with divisional plans and objectives, as recognized by both the senior team and the President.

- Funds added to the department by specific recommendation through the budget process may not be diverted to other purposes.

- Assigned reductions may not be exported, e.g. passed on to another department. Each reduction must result in a reduction of net University expense.

Departmental Carry Forward Funds

The University’s current practice is to allow, subject to approval by the President, a department to manage the spending of operating funds assigned to it and to carry forward any unspent funds to the next budget year.

In a similar manner (subject to Presidential review), departments are required to carry net overspending forward to the next budget year such that the overspending will be recovered in the following year. These amounts are referred to as the departmental carry forward funds.

Carry-Forward Process

At the end of each fiscal year the budget manager advises the President of any unspent funds that he/she wishes to carry into the forthcoming fiscal year. The President determines how much to permit the manager to carry forward. Any such amount will show as a one-time only (OTO) amount in the accounting system. Departments will spend as normal and make charges against the expense lines normally charged. The OTO amount will contribute on a bottom line basis only.

The idea of showing departmental carry forward funds as an OTO amount is to make it clear that the intent is not to have excess funds built up over time. Each year the President will decide where the current priorities are and how they will be funded. Maintaining the carry forward funds in this fashion allows for maximum overall budget flexibility.

Calculation

At the end of April, the divisional carry-forward amount for each Operating Fund Centre is calculated as the net of:

- Over/under spending against the expenditure budget, and

- Surplus/shortfall in meeting revenues/recoveries budget targets.

Monitoring/Forecasting

The operating budgets, which are now in departmental accounts as a result of implementation of the annual budget process, reflect detailed allocations of the Operating Fund. As such they represent spending limits. It is important for budget managers to monitor, on a monthly basis, the actual results against the approved budget in order to identify expected variances and take appropriate action:

- Eliminate or minimize forecast negative variances,

- Utilize favourable forecasted variances for other purposes, first to cover forecasted negative variances.

The Finance Department prepares the overall year end forecast for the University from input provided by the budget managers at 6 months and 9 months. This information not only signals possible overspending problems but also provides input to cash flow analysis which is critical to forecasting investment income.

The departmental financial reports provided by the Finance Department, referred to as “Responsibility Statements” are the starting point for monitoring monthly expenditures and for forecasting results to the end of the fiscal period. They reflect current budgets, actual revenues and expenditures to-date. In arriving at a forecast, future expenses, and unplanned revenue not yet reflected, must be taken into account. Each budget manager or business officer must reconcile her/his department’s accounts with the University’s financial system on a monthly basis. The Finance Department is always on hand to assist you in understanding your financial statements.

Making Adjustments

One option for dealing with forecasted variances is to reallocate budget from one account to another where appropriate, and where allowable. This would only be done in a multi-department situation.

Ancillary Operating Fund

Ancillary Operating Fund

Definition

The Ancillary Fund includes all revenues and expenditures of the residence, food service parking and conference operations of the University. All ancillary revenue and expenses are recorded in this fund. The Ancillary fund is kept separate for management and reporting purposes because these operations are intended to be self-funding and do not draw on other University resources.

Objectives

- To ensure that the University’s ancillary services are self-sufficient, do not create a burden or subsidy to the Operating Fund;

- That services provided from this area remain competitive both to the general market place in general and across the U of T campus in particular; and

- That residence and meal plan costs to students are kept as reasonable as possible.

Development

The budget for the Ancillary Fund is created through the annual budget process. Using a multi- year approach and through an extensive review process involving the managers of the ancillary departments (i.e. Food Services, Housekeeping, Physical Plant, and Conference Services), the Dean of Students, VUSAC, the Residence Presidents and the Bursar, guidelines are developed which are incorporated into the overall process. The budget process takes place during the months of October through January for presentation to the Finance Committee at its meeting in late January.

Implementation

Once the Ancillary Budget is approved, budget managers are notified and then asked to submit line-by-line details for entry into the accounting system using the following guidelines:

- Additions and reductions must be consistent with departmental plans and objectives, as recognized by both the senior team and the President;

- Funds added to the department by specific recommendation through the budget process are not to be diverted for other purposes; and

- Assigned reductions may not be exported, e.g. passed on to another department. Each reduction must result in a reduction of net ancillary expense.

Carry-Forward Process

Not applicable.

Monitoring/Forecasting

The ancillary budgets, which are now in departmental accounts as a result of implementation of the annual budget process, reflect detailed allocations of the Ancillary Fund. As such they represent revenue targets and spending limits.

It is important for budget managers to monitor the actual results against the approved budget in order to identify expected variances and take appropriate action such as:

- Eliminating or minimizing forecast negative variances

- Utilizing favourable forecasted variances for other purposes, first to cover forecasted negative variances.

The Finance department prepares the overall forecast for the Ancillary Fund from input provided by the budget managers. This information not only signals possible overspending problems but also provides input to cash flow analysis which is critical to forecasting investment income. The departmental financial/responsibility statement is the starting point for forecasting results to the end of the fiscal period. It reflects current budgets, actual revenues and expenditures to- date. In arriving at a forecast, future expenses not yet reflected in the account must be taken into account. Each budget manager or business officer must reconcile her/his department’s accounts with the University’s financial system on a monthly basis.

Conference/Academic

The Ancillary operation breaks easily into its conference and academic operations. The former being made up primarily of business ancillaries (e.g. conference and hotel business) and the latter being made up primarily of service ancillaries (e.g. students in residence). Within these two very different types of operations it is also important to ensure that there is no cross subsidy. The Finance department facilitates the performance of this analysis and works with budget managers to ensure an accurate assignment of revenue and expenses.

Capital Funds

Capital Funds

The University does not maintain a separate Capital Fund. Capital Fund Assets, which are normally defined to include all land, building, furnishings, computers etc., are coming led within the Operating and Ancillary Funds. The University does however have an extensive process for developing its Capital Plans.

Definition

Capital Plan

The Capital Plan includes all building, renovations, general repairs and maintenance of academic, ancillary and revenue generating properties.

Development

The Plan for Capital is created as part of the annual budget process. Using a multi-year approach and through an extensive review process involving the Director of Physical Plant, VUSAC, Dean of Students, the Bursar and the President, the Plan is developed. Development of the Plan takes place during the months of October through January for presentation to the Campus Life Committee, the Property Committee and then the Finance Committee at their meetings in late January.

Implementation

Once the Capital Plan is approved, the Director of Physical Plant is notified and then asked to submit line-by-line details for entry into the accounting system.

Carry-Forward Process

It is often difficult to have large projects completed by the fiscal year end. Any unspent funds, with the approval of the President, are carried into the next year. This approach means that anew allocation will not have to be sought for the remainder of the project.

Monitoring

The Director of Physical Plant prepares a quarterly up date of spending for each approved project along with a forecast to the end of the fiscal year. He works closely with the Finance department to maintain records appropriate to this task.

To facilitate this process the Finance department assigns a separate general ledger account for each approved project. All expenses are recorded in these accounts, which remain active until the Director of Physical Plant informs the Finance department that the project has been completed.

Capital Asset Overview

Capital Asset Overview

Definition

Capital assets, comprising tangible properties such as land, buildings and equipment, are identifiable assets that meet all of the following criteria:

- Are held for use in the provision of services, for administrative purposes, for production of goods or for the maintenance, repair, development or construction of other capital assets;

- Have been acquired, constructed or developed with the intention of being used on a continuing basis;

- Are not intended for sale in the ordinary course of operations; and

- Are not held as part of a collection. (i.e. fine art, special paper collections etc.)

Purchases

(See Victoria University Purchasing Policy)

At Victoria University, all purchases that meet the above criteria and have a life expectancy greater than one year and a value of $5,000 or more (excluding related costs, e.g. freight and taxes) are considered capital assets. This definition is applicable regardless of whether the purchase is funded by Operating, Ancillary, Capital or Restricted Funds.

Departments are required to keep track of all capital assets and be prepared to produce receipts in the case of an insurance claim. At a minimum, capital asset records should identify the cost and location of all assets owned by the University.

Disposals

Disposals refer to capital assets where title/ownership has been transferred to a party outside the University by way of sale, trade in or gift, or removed from service due to obsolescence, scrapping or dismantling. Departments play a key role in ensuring that all disposals are reflected in the University’s annual financial statements.

The following are general requirements with regard to the disposal of capital assets:

- Identify items at least once a year that are still located in the department but are no longer in use by the department;

- Identify items which are no longer in the department. These could include items that have been disposed of but not reported previously or items transferred to another department.

Any items falling under the above should be reported to the Finance department.

Restricted Fund

Restricted Fund

(See Policy Concerning Spending of Restricted Funds)

Definition

Restricted funds are those funds that are held for a specific purpose and are not combined with other funds of the University. The source of funds can be either external or internal. External includes for example, specific purpose grants and other amounts from outside agencies and donors. Internal include for example, carry-forward funds and other amounts designated by the President or the Board of Regents.

Monitoring

Restricted Funds are always identified with a particular Department, and as such, the account activity is reported through the accounting system each month.

Development and Implementation

Restricted funds are not budgeted per se as the source and timing of expenditures is often left to the individual in charge of the account. When funds are received it is the responsibility of the Budget Manager to contact the accounting office and discuss which accounts are most appropriate under the circumstances.

Overspending

Restricted funds are not allowed to fall into a deficit balance. If they do it is the responsibility of the Budget Manager to contact the accounting office with a plan for putting the account back into good standing.

Monies are placed into Restricted Funds as a way limiting their use for any other purpose. Doing so allows the University to ensure that funds entrusted to the University by sponsors and donors are used for their designated purpose. Funds in this fund can be restricted either internally or externally.

The Department Head ensures that:

- Controls are in place and operating effectively to provide assurance that University policies and procedures and the terms and conditions set by the restriction are being followed. Spending is in accordance with the Policy on Spending as referenced above. Accordingly, he/she obtains information on all restricted funds held by the department including its purpose and required signing authority.

- He/she is aware of all outstanding issues and problems.

- The monthly financial statements are reviewed and that any discrepancies are reported to the Controller’s Office immediately.

- Any required reporting is submitted on a timely basis.

Delegation of Signing Authority

Delegation of Signing Authority

(See Signing Authorization Form)

Objectives

Responsibility cannot be delegated. Accordingly:

- Delegation does not occur if precluded under policy, e.g. the policy on Travel and Other Reimbursable Expenses;

- Delegation must be on prescribed form;

- Authorization to approve is delegated to staff with the skill and knowledge necessary for the effective exercise of the authority; and

- The person with whom the responsibility rests, i.e. the delegator, exercises control sufficient to ensure the discharge of this responsibility.

Grant Holder/Financial Officer

- Obtains assurance that there is no delegation of authority when specifically precluded under policy and that delegation of authority is effective.

- Ensures that the delegation of the authority is communicated so as to ensure the delegated responsibilities can be carried out effectively.

- Delegates authority only when there is assurance that the control objectives of authorization of transactions will be effectively served.

- Sets parameters of delegation so that authority to authorize transactions of a certain value or sensitivity remains with the head of the department.

- Ensures that the delegation of authority is appropriately communicated so as to ensure that the delegated responsibilities can be carried out effectively.

- Complies with policies which preclude delegation.

- Documents delegation of authority through completion of the Delegation of Signing Authority Form.

- Establishes a method to ensure that delegated authority is being exercised in the manner intended.

NSERC/SSHRC Award Holders

NSERC/SSHRC Award Holders

According to NSERC and SSHRC regulations and as outlined in the Award Holder’s Guide, a student holding an NSERCCGS-D/PGS-D Scholarship or a SSHRC CGS/Doctoral Fellowship is required to complete and submit an annual progress report in order to renew their multi-year award. The Awarding Council may cancel the award if the student's progress is not judged satisfactory. This document may be used to continue a scholarship for a maximum of three academic terms.

Document your annual progress report using the Annual Progress Report form.

Student Awards Fund

Student award funds include funds for scholarships, bursaries, prizes and loans and are designated for awarding to/or the benefit of either Victoria College or Emmanuel College students. The source for the bulk of these funds is the Endowment Fund, which is invested to generate income in perpetuity for the support of student awards.

Monitoring

Student awards funds are reported each month through an Excel report generated by the Finance department. Money available for spending identified as income; awards granted identified as expenses. This report is given to the Registrar’s office 15 working days after each month end.

Transfers

Transfers of funds between student awards funds are limited to those that do not contravene donors’ terms and conditions, or are explicitly permitted by donors.

Overspending

Student awards funds are not allowed to fall into a deficit balance. If they do it is the responsibility of the Budget Manager to contact the Finance department with a plan for putting the account back into good standing.

Recapitalization

The Bursar and Registrar review the balance of awards spending accounts at the end of the year and determine whether any of the unspent funds should be returned to the Endowment Fund.

Specific Items — Controller's Office

Specific Items — Controller's Office

Bank Accounts

All bank accounts for Victoria University must be authorized by the Controller’s Office. All bank accounts must be reconciled monthly. Deposits are discussed in the next section. Controls over cheques:

- Access to cheques is restricted.

- Cheques require more than one signature.

- Cheques are not pre-signed.

- Payments must be supported by original invoices or receipts.

- Payments to individuals must receive payroll department authorization prior to payment.

Cash, Other Receipts and Banking

(Includes currency, cheques, credit cards, etc.)

Certain departments have made arrangements with the Financial Services Department to deposit funds directly with the University’s bank. Generally, these arrangements have been made where the department receives significant amounts of cash.

Departments that do not direct deposit are required to deposit their funds with the Controller’s office. Cash receipts received by departments should be brought to the Controller’s Office for deposit either weekly or when receipts amount to at least $500 or more. Receipts should be deposited intact and not used to finance expenditures or for any other purpose. Cash must be kept in a secure location while it is being accumulated.

Departments should advise their customers that cheques should be made payable to Victoria University. Cheques will be restrictively endorsed immediately upon receipt stating “For Deposit Only, to the Credit of Victoria University” by the Controller’s office.

Incoming Wire Payments

Wire payments should be coordinated with the Controller’s Office. This is important so that the customer is given the correct deposit information and that the Department is given due credit for all funds received in the University’s bank account.

Debit Card or Credit Card Facility

The Controller’s Office will provide guidance and assistance to any department wishing to set up a Debit Card or Credit Card Facility, which would allow the department to accept payments in addition to cash and cheques.

Records Management for Cash and Banking

Departments, regardless of whether they deposit direct or through the Controller’s Office should issue receipts for all cash received. The receipt should identify the date, the amount and the payee.

A log book should be kept in the department to record all receipts and subsequent deposits.

Petty Cash

Petty cash floats must be arranged through the Controller’s Office.

Controls over petty cash:

- Petty cash should be stored in a locked, metal cash box, which should be kept in a locked desk, cupboard or safe, and should have a custodian assigned within the department;

- Petty cash should not be mixed with revenues or deposits;

- The custodian should count petty cash periodically, balance the count and request a reimbursement. Reimbursements should be processed in time to record expenses within the fiscal period in which they were incurred.; and

- Individual petty cash expenditures should not exceed $50.00.

Petty cash may not be used for loans, cashing personal cheques or payments for services, except for personal services that are very small, non-recurring and where the recipient will not receive more than $500 from the University in the calendar year.

Accounts Receivable

Credit is extended from time to time to customers or other related organizations. It is the responsibility of the department granting the credit to keep the average collection period as short as possible by ensuring that no credit is allowed where there is a high risk of non payment and by ensuring that billings are issued promptly and accurately. Departments must obtain assurance that adequate credit checks are carried out on prospective customers, and that invoices for goods and services reflect the full cost of services or goods delivered.Reports from the Controller’s Office identifying overdue accounts and other billing issues must be dealt with promptly. All write offs and allowances for doubtful accounts must be discussed with the Controller’s Office.

The Department granting credit must obtain assurance that no goods or services will be committed or delivered without adequate assurance that the full invoice price of delivery will be collected in a reasonable time.

All legal and binding contracts must be approved by the Bursar.

Inventories/Supplies

Stocks of supplies and equipment are fairly easily converted to cash and often subject to theft, losses and pilferage. Thus, they represent assets that need to be protected. Since they also represent funds tied up, quantities should not be any larger than absolutely necessary and inventories should not remain on hand for so long that they become obsolete.

Supplies should be kept in a safe location and the department head should ensure that they are adequately safeguarded from theft and abuse.

Office supplies may be purchased through the use of Grand and Toy Account cards. When supplies are purchased in this manner, the purchaser will be provided with an invoice that is to be coded and sent to the Controller’s Office for payment.

Accounts Payable and Disbursements

When paying bills it is important to have evidence that the goods or services have actually been received or carried out by the vendor. If there is any dispute, the Controller’s Office should be informed immediately in order to withhold payment. Under the present arrangements, all invoices, once approved should be forwarded to the Controller’s Office for payment. The Controller’s Office produces cheques twice weekly and mails them directly to the payee. The Controller’s Office maintains a signing authorization form detailing who may sign for invoices and for what amounts. It is up to each department to ensure the form is up to date.

The University pays HST on all invoices but receives a rebate for two thirds of the amount paid. The Department is credited with the amount refunded. The Controller’s Office will provide Departments with a stamp that assists with the calculation. Departments must calculate the amount of the fund.

Purchasing is also covered under the Victoria University Procurement Policy.

Control Over Accounts Payable

- The Department Head should approve all charges to departmental accounts.

- An appropriate segregation of duties should be maintained, as far as possible. (E.g. the person who approves the invoice for payment should not be the person who actually receives the goods or services).

- Where authority to approve payments has been delegated, the Department Head must ensure that appropriate parameters and instructions are provided.

- Where purchase orders have been used, the Department Head should match the charges in the accounts to the purchase order and goods receipt or packing slip(s).

- Where purchase orders have not been used, the Department Head should review the supplier’s invoice in detail to ensure that charges are appropriate, and should ensure that the monthly statement of account has been charged accordingly.

Reimbursement of Expenses

(See Victoria University Travel and Hospitality Expenses Reimbursement Guidelines)

University faculty, staff and visitors may incur expenses which are eligible for reimbursement by the University. The objective is to ensure that prompt reimbursement is made for eligible expenses which are documented and which have been approved by one level of signing authority higher than the claimant.

The Department Head is responsible for ensuring that funds entrusted to the faculty member/department are used only for purposes consistent with the conduct of the University’s academic and research programs and activities in a cost effective manner. This equally applies to disbursements made to reimburse faculty, staff and visitors for out-of-pocket expenses incurred to meet the approved objectives.

The Department Head should ensure that there is a need for the expense prior to authorization and of the subsequent request for reimbursement prior to approval.

The majority of expenses for which reimbursement is required relate to travel. It is recommended that all travel arrangements be pre-approved prior to making travel arrangements. Considerations in providing approval for:

- Does travel represent the most economical means of accomplishing the stated objective?

- If the travel is to be funded from the Restricted Fund, does the travel relate to that restricted purpose?

- With respect to proposed travel arrangements, has appropriate consideration been given to the most economical arrangements?

For all other out-of-pocket expenses the Department Head should ensure that:

- The expenditures were for university business and the amounts were reasonable.

- The claim conforms to requirements in all respects.

- If expenses are being funded from a grant or trust fund, all applicable terms and conditions are met.

The Department Head must personally approve all expense reports within the department. This responsibility cannot be delegated.

Expense reimbursements should be filed on the Expense Reimbursement Form.

Victoria University follows the University of Toronto policy on Moving Expenses.

Accountable Advances

When the Department Head determines that the amount of the request is reasonable and that it is clearly not feasible to apply a more cost effective method such as use of a personal credit card, he/she may arrange for an accountable advance. This will be done through the prescribed Accountable Advance form. Please note that where receipts are not filed in support of the accountable advance, the amount therein will be considered taxable income and will be added to the person’s T4 slip at the end of the year.

Payroll and Benefits

Payroll and Benefits

Victoria University will follow the University of Toronto Income Tax Guide.

Salary and benefit costs represent the largest element of the University’s budget and it is important to ensure that payments to individuals providing services to the University are made accurately, on a timely basis, are properly authorized and comply with legislative requirements, University policies and collective agreements.

All employees’ information must be processed through the Human Resources (HR) Office prior to the employee being paid through the payroll system. Once duly processed through HR the information will be set up in the University’s HR/Payroll system and employees will be paid according to their relevant pay schedules.

Department Heads should send newly hired staff directly to the Payroll Office to fill out the new hire paper work such as TD1, Bank Information, and Benefit forms. Please note that non- Canadian citizens will be required to complete forms specific to their circumstances.

The Department Head will ensure that:

- All payroll forms are approved in accordance with the University’s process as in place at the time.

- Employment contracts are entered into by authorized individuals in accordance with University policies, procedures and granting agency requirements.

- Adequate segregation of duties exists within the department, as much as possible.

- All payments are authorized.

- Payments made are consistent with contracts and services and that they are performed in accordance with the terms specified.

- Adequate funds are available to cover salaries before entering into agreements and that payments made from grants and Restricted Fund must cover both salaries and benefits.

- He/she fully understands or consults with the Human Resources/Payroll Department as required, and applies the principles of the University Income Tax Policy and Guidelines (as referenced above) when negotiating contracts with individuals to ensure they understand their relationship with the University for Tax Purposes.

- Payments to individuals deemed under the Tax Act to have an employment relationship with the University are processed through the payroll system.

- Time sheets for each employee are filed in accordance with the Schedule of Timelines prepared annually by the Payroll Department.

- The Payroll Earnings Statement as provided by the Payroll Department is distributed in a timely fashion to the employee.

Purchasing and Payments to Vendors

Purchasing and Payments to Vendors

Payments to Vendors are covered under the Section on Accounts Payable and Disbursements.

Purchasing cards are provided to certain departments based on approval of the Bursar. The following rules apply to University issued purchasing cards:

- Personal purchases are not allowed.

- The card may only be used by the person to whom it has been issued unless additional signing authority has been approved by the University and processed through the bank.

- The monthly statement provided by the Bank must be reviewed promptly and any purchases that would normally require the next level of authorization must be approved.

- All purchases must be coded and receipts must be provided; a) such that the integrity of the audit trail is maintained, and b) for HST purposes.

- If a card is lost stolen or misplaced it must be reported immediately to the Bank and the Controller’s Office.

Gifts

When a gift may be given:

- The reason for giving the gift supports the mission of the University; and

- It is permitted under the terms and conditions of the funding source

Appropriate reasons for giving a gift include:

- A token of appreciation for participation in an event;

- A non-cash award for winning a competition or contest;

- A non-cash prize for attending an event;

- Expressions of sympathy;

- Retirement; and

- Recognition

Restrictions

- For Employees, a gift of cash is prohibited. Gift cards, gift certificates and travel vouchers are considered to be equivalent to cash and are therefore, not permitted;

- Gifts of alcohol for Employees and Non-employees are also prohibited;

- Employees must be aware of a maximum threshold of CAD $500.00 as an allowable expense for the purchase of gifts. This threshold represents a total value of all the non-cash gifts and an award purchased in a year per employee, and does not fall under a taxable benefit requirement. Gift purchases above an established threshold must be recorded as a taxable benefit. It is the Authorized Approver’s responsibility to monitor maximum threshold spend per employee for the purchase of gifts.

Pre-Approval Requirements

Gifts will be approved in advance by an Authorized Approver and the reason for the gift purchase must be explained in detail and justified.

The actual payment must be supported by an original receipt. The recipient of the gift must also be identified.

Items of small or trivial value will not be considered a taxable benefit. These items are not included when calculating the total value of gifts and awards given in the year in order to apply the threshold.

Examples of items of small or trivial value include:

- Coffee or tea

- T-shirts with employer's logos

- Mugs

- Plaques or trophies